IC Markets Review

IC Markets is one of the world’s only True ECN forex brokers providing trading solutions for active day traders and scalpers as well as traders that are new to the forex market. IC Markets offers its clients cutting edge trading platforms, low latency connectivity and superior liquidity. IC Markets is revolutionizing on-line forex trading, on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks and high net worth individuals.

their management team have significant experience in the Forex, CFD and Equity markets in Asia, Europe and North America. It is this experience that has enabled them to select the best possible technology solutions and handpick the best liquidity available in the market.

IC Markets mission is to create the best and most transparent trading environment for retail and institutional clients alike allowing traders to focus more on their trading. Built by traders for traders IC Markets is dedicated to offering superior spreads, execution and service.

IC Markets Licenses

IC Markets – authorized by ASIC (Australia) registration no. ACN 123 289 109. AFSL 335692

IC Markets Trading Platforms

IC Markets offers advanced software proposals too. MetaTrader 4 and MetaTrader 5 and cTrader are three of the best trading platforms available in the market today, hence IC Markets have these options in their direct access to provided ECN trading environment.

The offer Auto trading compatible with all broker’s platforms, EAs at MT4 or MT5 , myfxbook at cTrader platform and as an addition, ZuluTrade is available too. ZuluTrade is one of the best social trading platforms that allow to choose among thousands of talented traders and to follow their trading signals for free.

They additionally offer MAM and PAMM multi-account management systems that are flexible and easy to use tools.

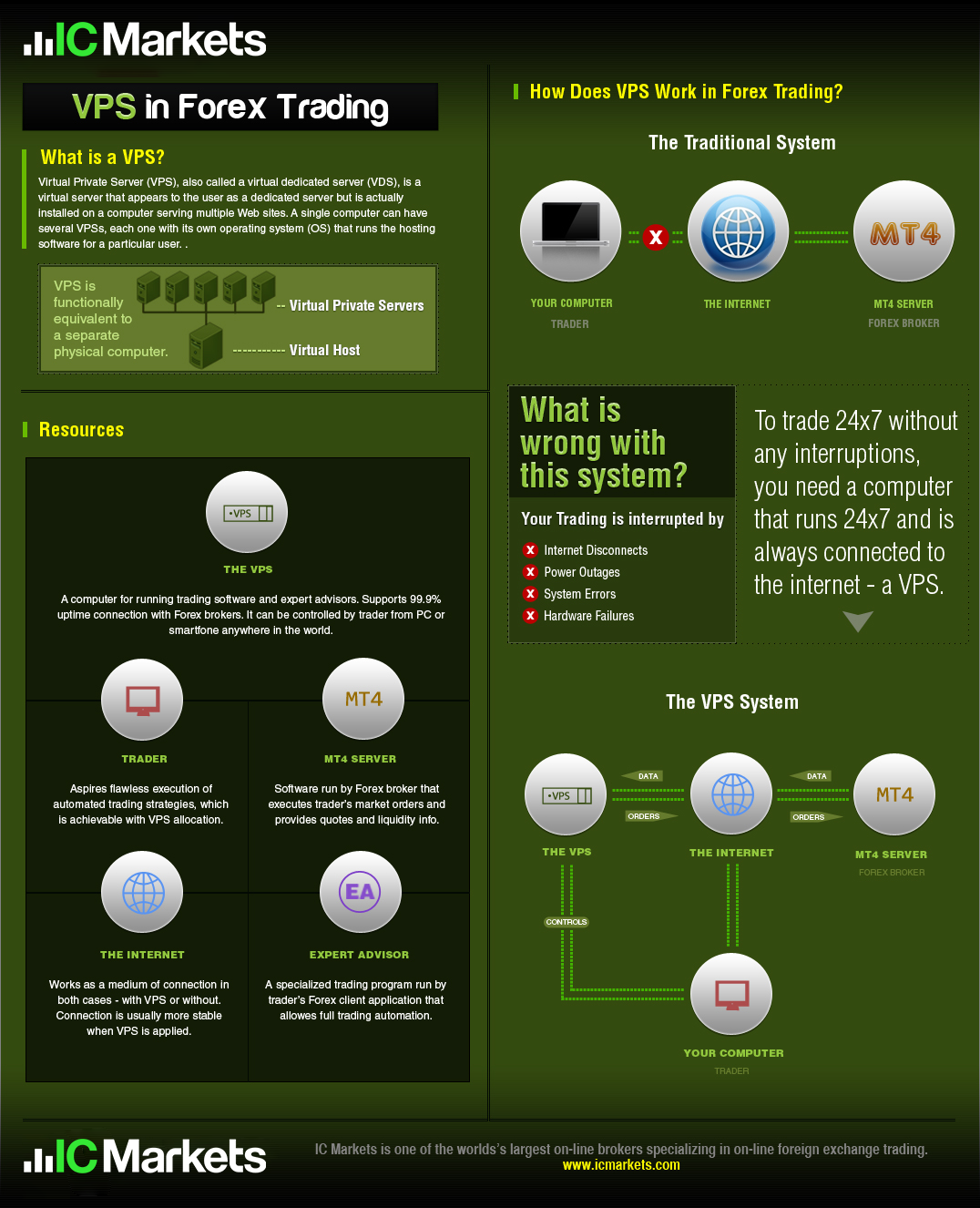

FIX API delivers great opportunity for high volume traders, while VPS (Virtual Private Server) allows you to run a variety of automated trading strategies with a possibility to get free VPS use (if a required minimum volume of 15 round turn (FX) lots per calendar month is reached).

Overall, IC Markets truly brings trading into the next level by comprehensive tools, additions and extensions to the platforms such as a one-click trade module, market depth, spread monitor, trade risk calculator and advanced order types previously not available on MetaTrader 4.

Account types

There are three main account types that are featuring the same compatibility and power provided by the company, yet are designed to meet the expectations and needs of different trading styles.

The accounts are available in multiple currencies, up to 10, are fully segregated from the company’s funds and supported by multi-lingual customer team.

The traders that follow Sharia rules can sign for Swap free or Islamic account as an option at IC Markets too, along with risk-free demo account on both MT4.MT5 and cTrader that allows practice of the trading strategy.

IC Markets Accounts

institutional grade liquidity

IC Markets fees

So now let’s check on a difference between the trading fees on applicable accounts, as the fees slightly diverse. The Standard Account enabled through MetaTrader4 with CNS VPS Cross-Connect and spread only basis from 1.0 pips. The True ECN account allows micro lot trading from 0.01 size, deep institutional grade liquidity, ECN spreads from 0 pips and commission of 3.50$ per 100k traded available at MT4 also. Spreads on EURUSD averages at about 0.1 pips 24/5, which is as per the IC Markets expert advisors is currently the tightest average EURUSD spread globally. cTrader ECN account offering approximately the same feature as MT4, but with the difference of the platform that is used by mainly professional traders of bigger size. The applicable spread also starts at 0.0 pips and commission of 3.00$ per 100k traded that serves execution through Equinix LD5.

IC Markets leverage

IC Markets offering leverage up to 1:500 that opens the path to the forex market for Retail traders with quite low or small initial deposit to cover margins. The use of leverage can magnify gains but you should always remember that losses can also exceed your initial deposit. As leverage is known as a loan given by the broker to the trader to enable trading with a bigger capital and increase potential gains. However, we would recommend to any trader use tool smartly and read carefully how to set up correct leverage to a particular instrument or trading strategy.

IC Markets Deposits and Withdrawals

IC Markets offers 10 flexible funding options in 10 major base currencies AUD, GBP, JPY, HKD, SGD, NZD, CHF, CAD, EUR, USD. From the client secure area, there is an ability to deposit or withdraw funds throughout Cards, PayPal, Bank Transfer including local ones, Neteller, Skrill, WebMoney, Qiwi, China UnionPay, FasaPay and more.

IC Markets minimum deposit

The Standard Account enabled through MetaTrader4, along with other two account types available at IC Markets are set with the minimum deposit of 200$ to start.

Conclusion on IC Markets

IC Markets Brings a truly advanced trading offering, while you are able to choose from a wide range of instruments to trade, and what platform to trade on.

there is autotrading and social trading o

Along with true ECN and very competitive pricing strategy based on spread only or with lowest spreads but commission per trade, the broker delivers widen a range of markets to choose from, as well as a strong offering of Cryptocurrency.